New research published by the B4Ukraine coalition in collaboration with the Kyiv School of Economics and Squeezing Putin reveals how foreign businesses, including many household names, continue to channel billions in taxes to the Russian state nearly three years into its war on Ukraine. The report “Corporate Enablers of Russia’s War in Ukraine: A Closer Look at Multinational Taxes and Revenue in Russia in 2023” calls on companies to make a swift responsible exit from the Russian market and urges the G7 and allied countries to establish standards for corporate behavior, promoting immediate exits from the Russian market.

In 2023, 1,600 multinational corporations—almost three-quarters of those with local Russian subsidiaries at the start of 2022—continued to do business in Russia, contributing to its illegal war of aggression in Ukraine. These companies, including some that have since exited, made over $196.9 billion in revenues through their Russian subsidiaries, with $16.8 billion recorded as profit.

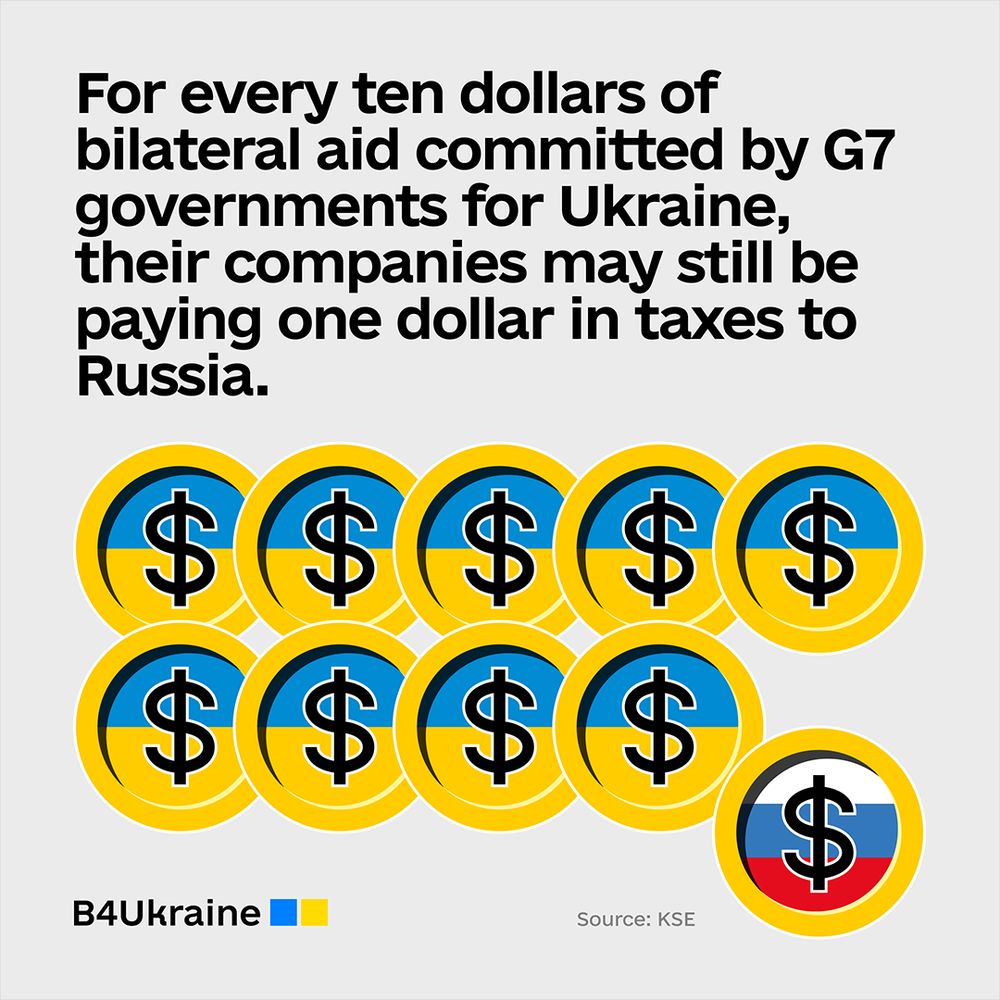

In 2023, foreign multinationals paid an estimated $21.6 billion in total tax, bringing the total estimated taxes paid to $41.6 billion since the start of the full-scale invasion in 2022. $41.6 billion is equivalent to just under one-third of Russia’s estimated 2025 military budget, highlighting the major financial contribution these foreign firms still have on the Russian economy.

“Despite Russia’s widespread atrocities and over 150,000 documented war crimes in Ukraine, far too many Western companies still operate in Russia, bolstering its war economy, jeopardising international law, and undermining their governments’ foreign policies. It’s time for them to leave,” said Nezir Sinani, Executive Director of the B4Ukraine coalition.

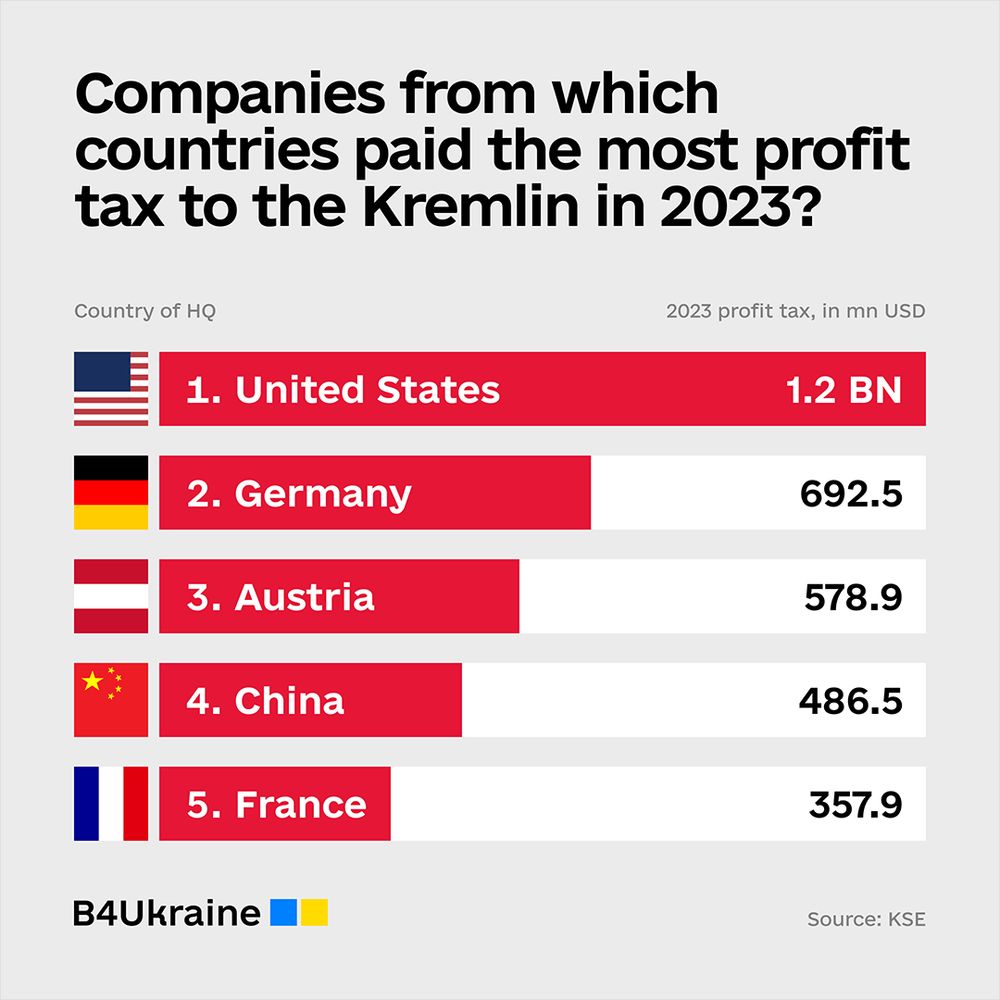

Companies based in nations committed to supporting Ukraine’s defence effort remain among the largest contributors to Russia’s tax base. These 930 G7 and EU firms were the top profit taxpayers in Russia, with 17 of the top 20 contributors coming from these nations. In 2023, 827 firms headquartered in EU member states generated $81.4 billion in revenues and paid $3 billion in profit tax.

On a country basis, American firms generated the largest total revenues in Russia and emerged as the Kremlin’s most substantial contributors through profit taxes, paying $1.2 billion in 2023. Germany follows, with its companies paying $692.5 million in profit taxes to the Kremlin in the same year. This is particularly striking given that the United States and Germany, two major donors, have collectively committed over $125 billion in bilateral aid to Ukraine since the invasion.

The Fast Moving Consumer Goods (FMCG) sector plays a pivotal role in sustaining corporate contributions to the Russian budget. In 2023, this sector—which includes household names such as Mars, Nestle and Procter and Gamble—led the way as Russia’s top earners, followed by alcohol and tobacco (Philip Morris, Japan Tobacco International) and food and beverages (PepsiCo, Mondelez, Coca-Cola HBC). Combined, these consumer sectors brought in a huge $587.52 billion in revenue and paid $1.5 billion just in profit tax, therefore outearning their nearest competitors in finance and automotive sectors.

Companies remaining in Russia will pay even more in corporate taxes to the Kremlin in 2025 and beyond. Changes to the Russian Tax Code will see the corporate profit tax rate rise from 20% to 25%, beginning in 2025, marking a key step in Moscow’s strategy to instrumentalise Western business presence to secure additional revenues. Meanwhile, domestic firms in Russia’s military-industrial sector are being subsidized by the Kremlin, enjoying new tax breaks, subsidies, and preferential leasing programs.

Nataliia Popovych, member of the B4Ukraine coalition, said: “Though some have reaped short-term financial gains, they are now effectively hostages to their own greed—facing rising taxes, demands to support the Russia military and becoming targets of overnight expropriation. It’s time to acknowledge the increasing responsibilities that go beyond the bottom line. No corporate mitigation efforts can address the systematic and grave abuses caused by Russia’s illegal invasion of Ukraine.”

B4Ukraine calls on companies operating in any capacity in Russia to exit in order to minimize contributions to the war economy, avoid complicity in human rights abuses, and align with international human rights obligations. B4Ukraine also urges G7/EU governments to use all available means to urge companies to cut ties with Russia, including establishing clear standards for corporate conduct and introducing deterrent measures such as financial penalties, restriction to access to contracts and exclusion from public procurement opportunities for companies which continue doing business with Russia.