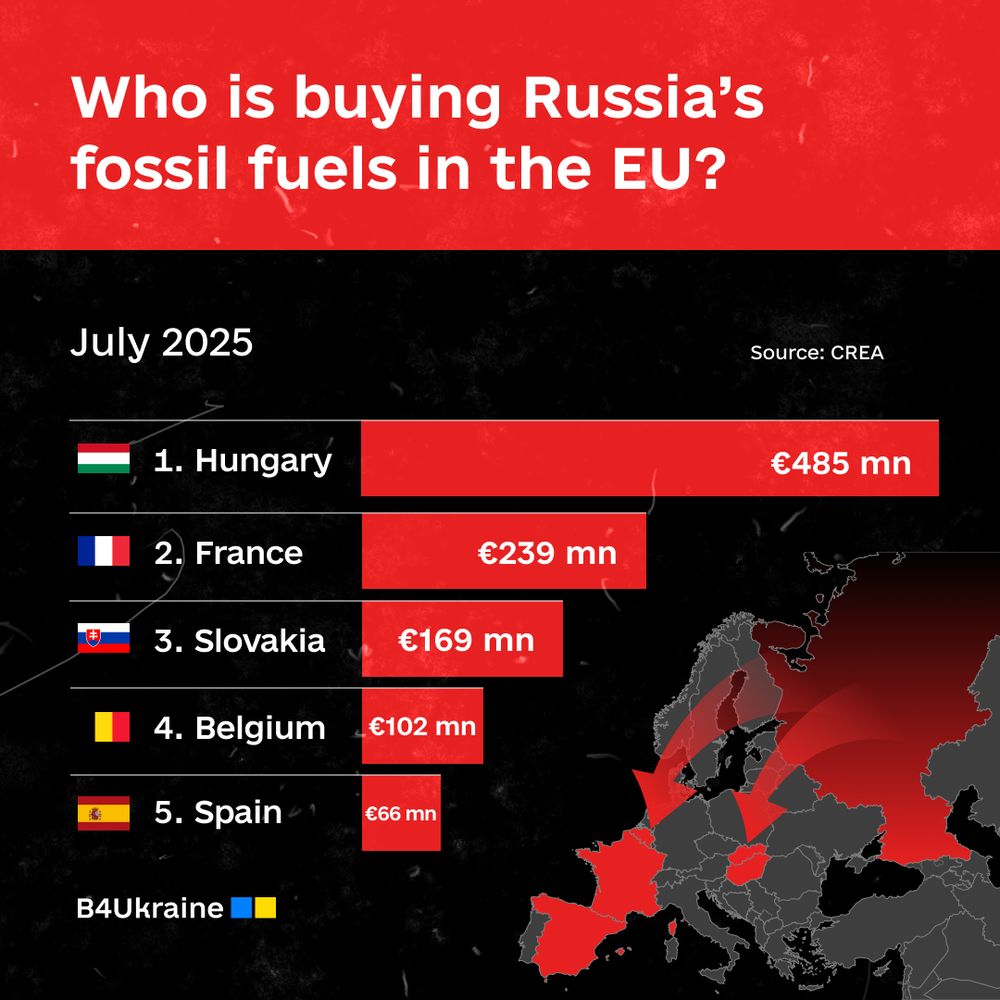

In July, the EU’s top 5 importers paid Russia €1.1 billion for fossil fuels, according to the Center for Research on Energy and Clean Air (CREA). The EU does not sanction natural gas, which accounts for over 67% of these imports. In July, it was primarily delivered via pipeline or as liquefied natural gas.

Hungary was the largest EU importer of Russian fossil fuels in July, purchasing €485 million worth. These imports included crude oil (€200 million) and pipeline gas (€285 million).

France ranked second, importing Russian fossil fuels worth €239 million, all in the form of LNG. However, gas imported via France is not necessarily consumed domestically. A study indicates that some Russian LNG entering through the Dunkerque terminal is subsequently delivered to Germany.

Slovakia was the third-largest importer. Seventy-nine percent of its imports consisted of crude oil transported via the Druzhba pipeline, valued at €169 million. The derogation allowing Russian crude oil to be refined into oil products and re-exported to Czechia expired on June 5.

Belgium ranked fourth, with imports totaling €102 million—all Russian LNG.

Spain, in fifth place, imported exclusively LNG from Russia, valued at €66 million.

The EU was the largest buyer of Russia’s LNG, purchasing 51% of total exports, followed by China with 21% and Japan with 18%. It was also the largest buyer of Russia’s pipeline gas, accounting for 36% of exports, while China purchased 30% and Turkey 27%.

In July 2025, an estimated €127 million worth of Russian oil was transferred daily via ship-to-ship operations in EU waters—a 44% decrease from the previous month. G7+ tankers conducted 86% of these transfers, while the remainder involved “shadow” vessels, which are often uninsured or registered under flags of convenience.

We can and must do more to choke off Kremlin war funding:

• Lower the oil price cap

• Close sanctions loopholes, including the “refining loophole”

• Ban unsanctioned fossil fuels like LNG and pipeline gas

• Increase monitoring and enforcement of sanctions

CREA’s July 2025 monthly analysis on fossil fuel exports from Russia is available via the link.