The essential role of Russia’s oil and gas sector in its continued aggression against Ukraine cannot be overstated. Therefore, we are launching a new rubric devoted to oil and gas and the invaluable research and analysis done by several members of the B4Ukraine coalition. Center for Research on Energy and Clean Air (CREA) is one of such members that regularly publishes valuable analyses on Russia’s fossil fuel sector, including its weekly and monthly snapshots. We are delighted to highlight their findings in order to bring awareness and clarity for policymakers. Such findings should be used to critically examine the existing issues and devise suitable policies in order to limit Russia’s use of energy as a key source of war financing.

6 things you should know about Russia’s fossil fuels exports in September

1. Volumes & revenues: The volume of Russia’s fossil fuel exports fell in September to its lowest monthly level recorded since Russia’s full-scale invasion of Ukraine. However, revenues increased month-on-month for the second month in a row due to rising oil prices and the failure of Ukraine’s allies to revise and enforce the price cap on Russia’s oil exports, which currently stands at $60 per barrel.

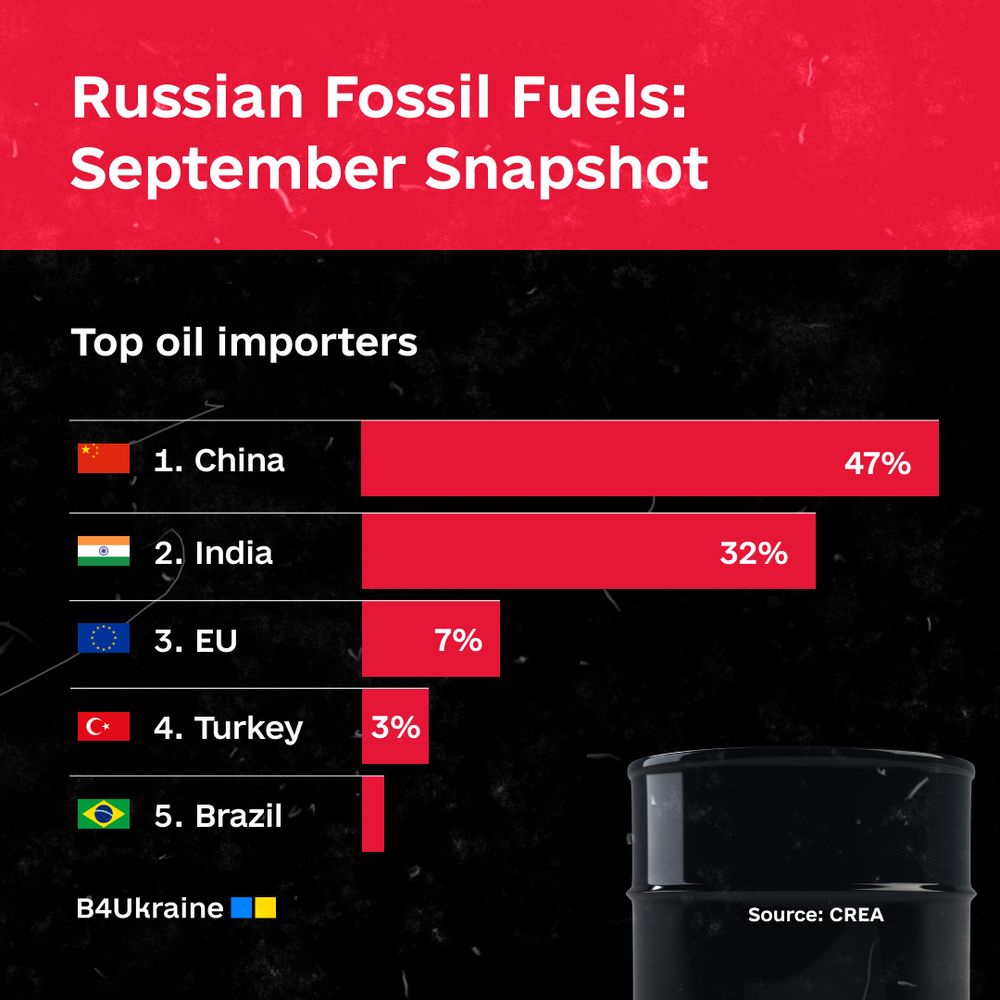

2. Key oil importers: China was the largest importer of Russian fossil fuels (47%), followed by India (32%), the EU (7%), Turkey (3%), and Brazil in September.

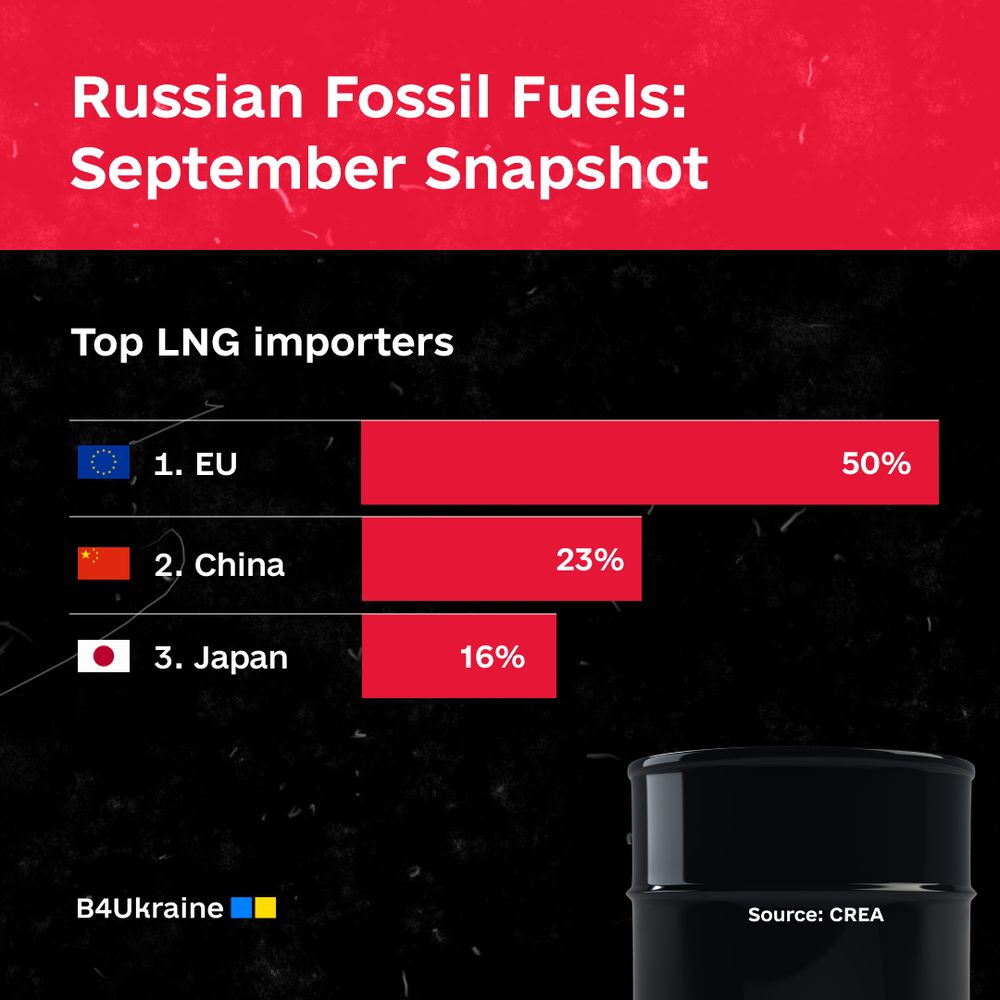

3. LNG export growth: The most significant month-on-month increase in the value of Russia’s fossil fuel exports came from Liquified Natural Gas (LNG), which experienced a 48% growth compared to the month of August.

4. Key LNG importers: Since 5 December 2022, the EU has been the largest buyer of Russian LNG, purchasing 50% of Russia’s LNG exports, followed by China (23%) and Japan (16%). No sanctions are imposed on Russian LNG shipments to the EU.

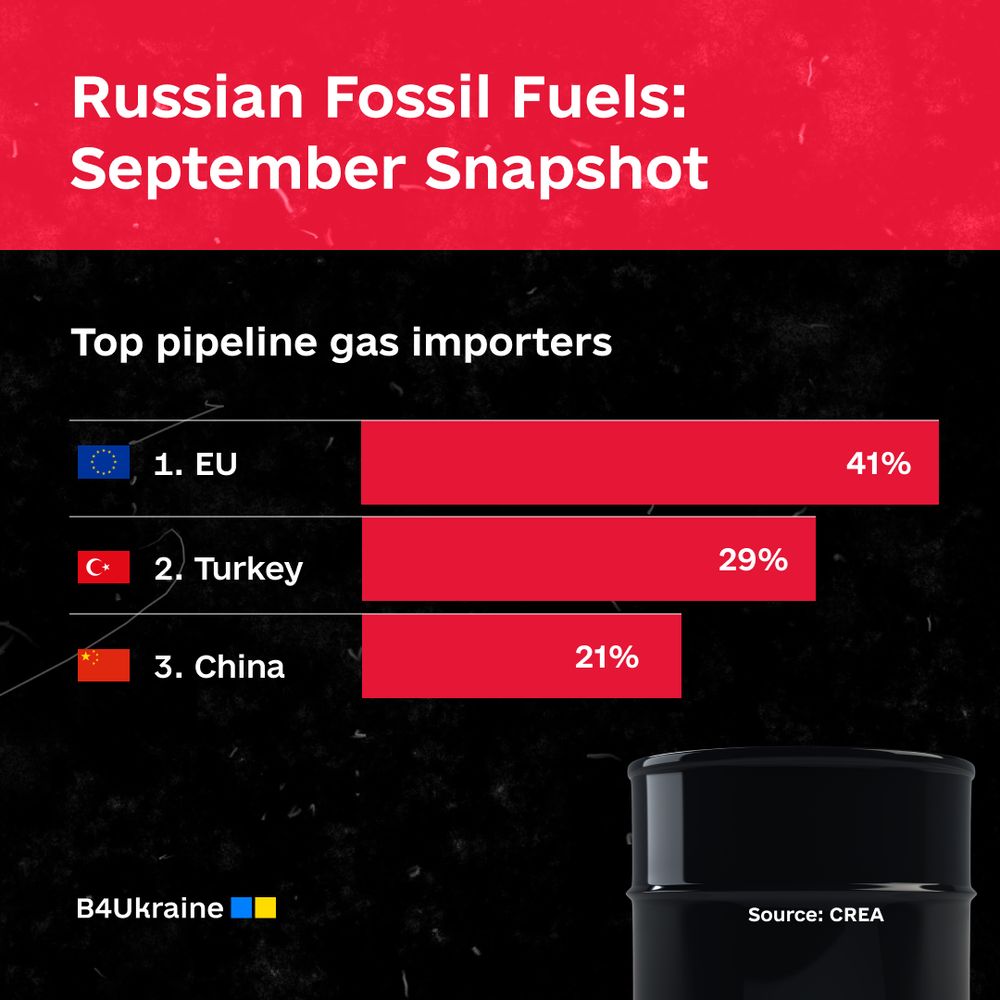

5. Pipeline gas: The EU was the largest buyer, purchasing 41% of Russia’s pipeline gas, followed by Turkey (29%) and China (21%). No sanctions are imposed on Russian gas via pipeline into the EU.

6. EU’s tankers: The European and G7 shipping industry plays a significant role in transporting Russian oil. The percentage of tankers subject to the price cap transporting crude oil shipments from Russia remained at approximately 50% in September.